Apologies for spotty service lately. A mix of travel, Easter, unending work and a family bereavement meant that BTD had to take a mini-break. But it’s back with links galore, and one fun little tidbit from an investment conference I attended this week.

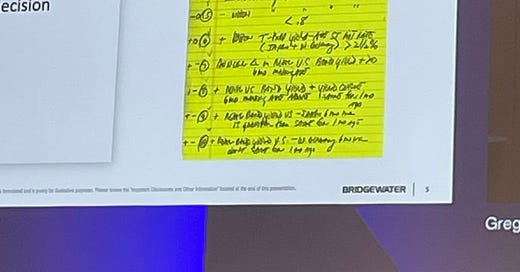

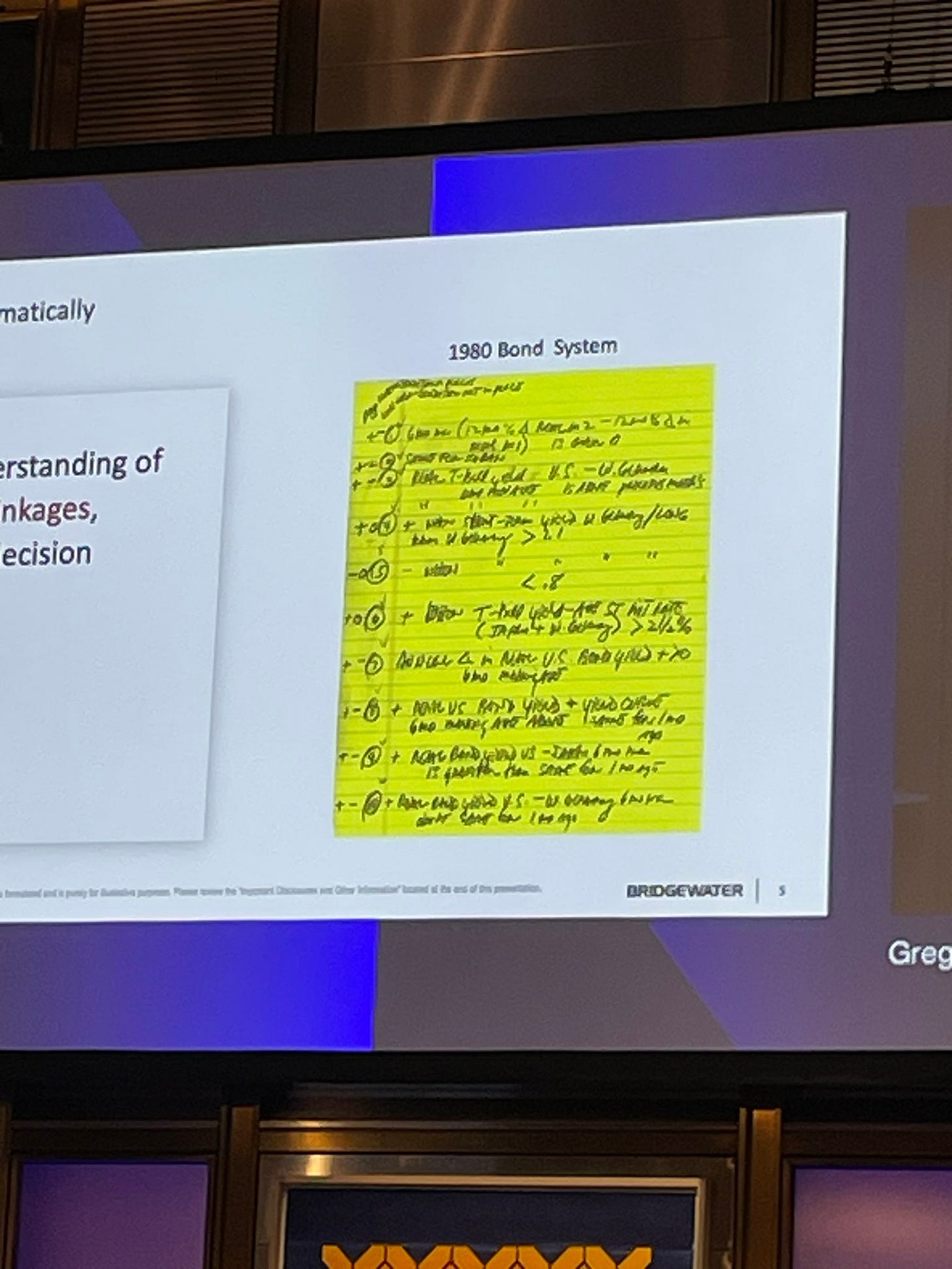

This is apparently what Bridgewater’s “investment engine” looked like back in 1980.

By the way, the travel was to New York to host the FT Alphaville pub quiz, which went really well. You can read the write-up here, and see how you might have performed (the winning team from GIC managed to get just over half the questions).

We really want to make a NYC pub quiz a more regular thing – and maybe take the show on the road – but we need a sponsor to do so. So get in touch if you have some spare marketing budget down the back of the sofa.

Here is a round-up of some of the stuff we’ve been up to since the last BTF.

📈 Small stocks, big problems. Does size matter any more? FT Alphaville examines the ‘death of small-caps’ narrative.

📈 The inequity method of accounting. California family learns about private-equity hardball while selling supermarket chain.

📈 Do investors actually read bond docs? An accidental FT Alphaville experiment.

📈 Trump Media’s auditor is really bad at spelling his own name. Meet Ben F orgers (we wish we were making this up).

📈 El Salvador’s ‘absurd’ bond deal. Lord, make me solvent, but not yet.

📈 Music to shill coins by. Tron (crypto, not movies) gives itself a soundtrack.

📈 Liz Truss’s certifiable bat skit. The PM who knew too much goes a bridge too far.

📈 Behold, the Basquiat bond. Breaking down Sotheby’s foray into art-backed securities.

📈 Welcome to crypto archipelago. One tiny, lightly regulated African nation plays an oversized role in global token trade.

📈 What happens when a central bank runs out of money? And is the Bank of England asking for a friend?

📈 Who’ll buy the Treasuries? (Alphaville’s version) Chatting with a semi-interested American about semi-annual interest.