Buy The Dip: The Louisiana Purchase, crypto factors, ARK's fantasy forecasts

Behold, the prospectus for one of the biggest bond sales in history

When the first iteration of this newsletter started back in the innocent, halcyon era known as pre-2016, one of the motivations was having an outlet for less fleshed-out thoughts, more flexibility, some ‘voice’ and a bit of experimentation.

Now that I mostly write for FT Alphaville, I don’t really need anything like that. I’m therefore wary of taking something that should be an FT article or AV post and turning it into an installation of BTD. But I’m also wary of wasting your time on substandard verbiage here.

So from time to time this newsletter will be fairly bare-bones (when I have little to say) and other times it will be extravagantly long. And occasionally - like today - it will have some tidbits from my ongoing bond book project.

I’ve now finished (very) rough drafts of chapters on the birth of the bond market in 12th century Venice; how the Dutch used bonds to fight the elements, win independence and build a worldwide empire; the English Consol market’s crucial role in Napoleon’s defeat; Alexander Hamilton and the birth of Treasuries; and the rising role that bonds played in a series of strikingly modern but delightfully colourful financial crises in the 19th century.

One of my main early takeaways is that there were an awful lot of wars back in the day! Yes yes, I know. I’m above-average interested in history (and have wasted many hours on Europa Universalis IV) so this wasn’t really a surprise. But at times it’s been struggle to keep all the unimaginatively-named wars straight so that each twist and turn is put in the right context.

Just to take some examples from the top of my now-overflowing head, the Seven Years’ War, the Nine Years’ War, the Eighty Years’ War, the Thirty Years’ War, the War of the Spanish Succession, the War of the Austrian Succession, the Quadruple Alliance War, the Franco-Dutch War, four different Anglo-Dutch Wars, and all those French Revolutionary Wars. Oh and the shenanigans of 1776. One honourable exception to the humdrum war-names: the War of Jenkins Ear.

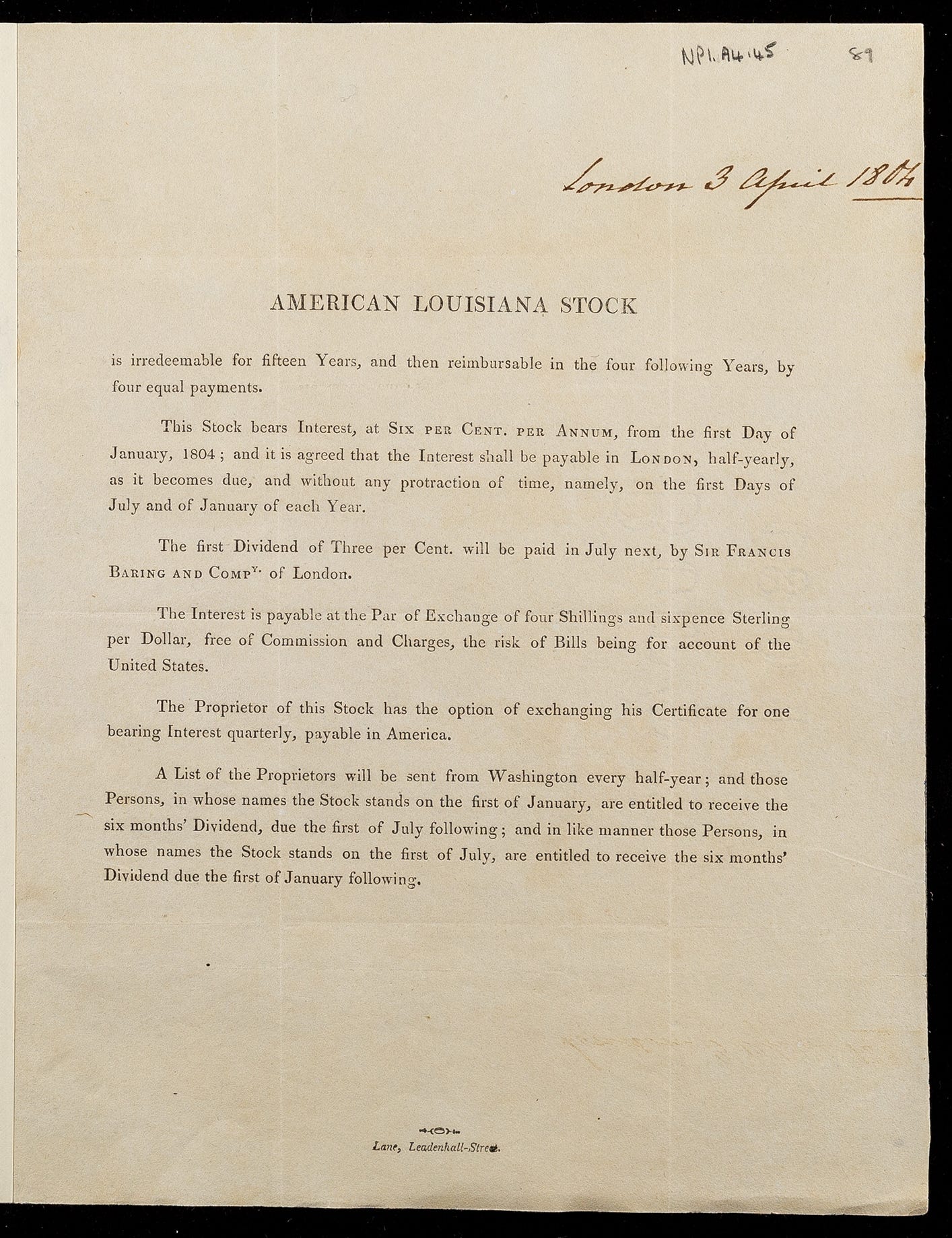

But it’s been exhilarating, especially when I find things like the original Baring Brothers prospectus for the $11.25mn bond sale to finance the Louisiana purchase (see below) – arguably the single biggest bond sale in history.

Fun fact: Barings and Hope & Co - its Dutch merchant bank partner in the deal - probably made about $1.5mn from the deal. Given the price that Louisiana went for, that’s the equivalent of the value of all of Nebraska. No wonder that Sir Francis Baring wrote to a partner that “we all tremble at the magnitude of the American account”.

To the investment bankers reading this, what are you even doing with your lives if you don’t have a deal like this under your belts?

On to this week’s links:

📈 ARK Invest’s ‘seemingly outlandish’ economic forecasts. Very much a pure ‘shitpost’

📈 Here’s your chance to not buy a painting. Bryce is unimpressed by the first attempt at fractional art ownership

📈 What do box office receipts, onions and tea have in common? No futures markets!

📈 Could Altice USA’s change-of-control covenants stop a deal? No, probably not, but a deal still doesn’t make a ton of sense.

📈 Would honey by any other name cause such legal consternation? More tales from the tribunals.

📈 The Bank of England is misusing its fiscal powers. Daniela Gabor isn’t happy about the indemnity.

📈Crypto factor investing. Every day we stray further from God’s light

📈 Only two sleeps left until February 31! You’d be surprised how many filings reference a non-existent date.

📈 Eurostat vs Eurostat stats. Cherry-picking dodgy stats is not a great look for a statistics body.

📈 Shein’s London IPO flirtation. Can the LSE regain its Shein (sorry) with a blockbuster float?

📈 Don’t bank on office-to-home conversions. US commercial real estate prices have a LOT further to fall before that becomes more feasible.

📈 The pros of the ballooning shadow banking system. Jacking up capital requirements won’t hurt as much as it used to.

📈 ‘Sell Apple’. To justify its current valuation, UBS reckons everyone everywhere needs to spend $800 a year on Apple products.

📈 CRE and systemic risk. It’s probably not going to cause a financial crisis, but non-bank lenders and investors are still worth a look

📈 Does alcohol + rap music = an investment case? Tequila making hip-hop inroads, but Cognac remains king.

📈 How to get around Russian reserve seizure nervousness. Lee Buchheit has an intriguing idea.

📈 Bonds are BACK. At least judging from Pimco’s results.

📈 When Wall Street’s co-heads cannot cohabitate. Like everyone else, we can’t get enough of Goldman psychodrama.