I'm back (ish)

And I come carrying two announcements

Hi, sorry for the almost two year silence. To my shock it turned out that a demanding job, a book project and three kids is even less conducive to regular newsletter-writing than a demanding job, a book project and two kids.

Moreover, I suspect that everyone suffers from newsletter overload right now, so I didn’t want to bother you until I actually had something interesting/important/fun to say. But now I do!

First up, kompromat years of lobbying has finally won FT Alphaville its own newsletter, right here on Substack. It’s weekly, anchored by my colleague Bryce Elder, and — like Alphaville itself — completely free. So please sign up. We even got some snazzy new graphics to mark the launch.

Second, I have now finally finished my latest book.

It remains to be seen if I’ve managed to defeat the difficult-second-book syndrome, but it is now a real, actual thing, with words strung together in sentences, paragraphs and entire chapters. It spans the bond’s birth in 12th century Venice to today’s Treasury market basis trades, and dives into everything from Dutch perpetuals, Liberty Loans and the genesis of rating agencies to modern money markets, quantitative easing and credit-default swaps.

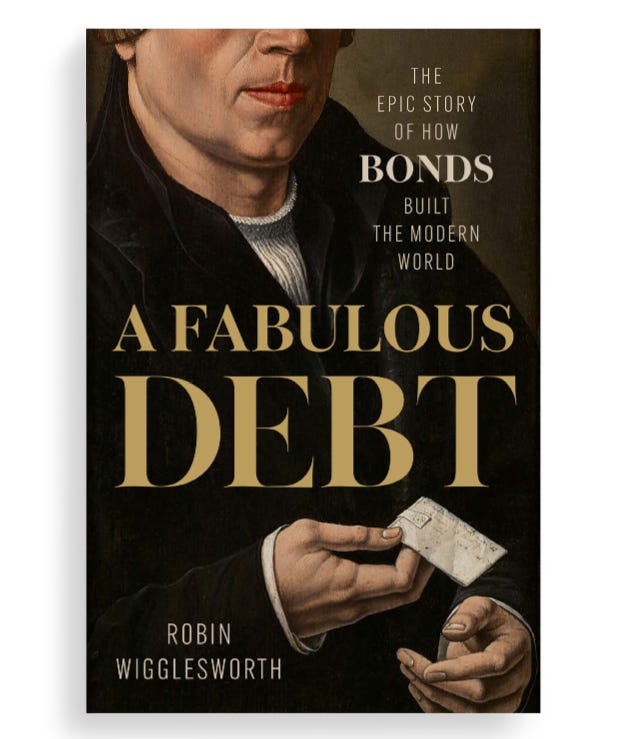

It also has a title and a provisional cover, which you’re now the first to see outside of me, my publisher, and a few distinguished tastemakers I asked for input (my kids).

Sadly, Penguin Random House wasn’t crazy about Damn He FICC: How The Bond Market Got Hot as a title, but hopefully A Fabulous Debt: The Epic Story of How Bonds Built the Modern World captures the grandeur of the story I’ve tried to write, as does the cover.

The book isn’t out until this coming autumn, but it looks like you can already place preorders at places like Barnes & Noble, Waterstone, Bookshop.org, Amazon US and Amazon UK. I note with abject horror that some of the summaries now call me a “veteran” journalist. It’s also due to be published in Chinese, German, and Japanese, and hopefully more to come.

The big, annoying borderline-desperate pre-order push won’t start yet, but if you like the sound of A Fabulous Debt I’d be honoured if you pushed your purchase in now (they are immensely important to authors, as you’ve probably heard many times now).

In case you’re curious, the title comes from Thomas Babington Macauley. This is not the Macauley of Macauley Duration (sadly), but a British politician who is mostly famous for his elegant History of England, first published in 1848.

Towards the end of the book Macauley skewers the debt scolds of his day, who had repeatedly predicted that that the gigantic financial liabilities imposed by incessant conflicts would spell England’s doom. These fears ballooned in the aftermath of the Napoleonic Wars, but once again proved unfounded — as the historian noted with relish.

It was in truth a gigantic, a fabulous, debt; and we can hardly wonder that the cry of despair should have been louder than ever. But again that cry was found to have been as unreasonable as ever.

After a few years of exhaustion, England recovered herself… The beggared, the bankrupt, society not only proved able to meet all its obligations, but, while meeting those obligations, grew richer and richer so fast that the growth could almost be discerned by the eye.

In every county, we saw wastes recently turned into gardens: in every city, we saw new streets, and squares, and markets, more brilliant lamps, more abundant supplies of water: in the suburbs of every great seat of industry, we saw villas multiplying fast, each embosomed in its gay little paradise of lilacs and roses.

Indeed, as I argue in my book, not only did the British bond market help the country defeat Napoleon, the “fabulous debt” became essential fuel for the Industrial Revolution that blossomed soon afterwards. (It also blew up in spectacular fashion later on, causing what is arguably the first true global financial crisis, but that is a subject for a later chapter.)

Anyway, thanks to Macauley for the title, my editor Noah Schwartzberg for shepherding it towards completion, and every one of you who might end up reading it. It’s been a labour of love.

Never thought I’d say “fuck yeah” to a book about the history of bonds. But here we are. Should Fabozzi be worried?

Legene - just pre-ordered! Damn He FICC: How The Bond Market Got Hot, will at least be an Alphaville teeshirt?